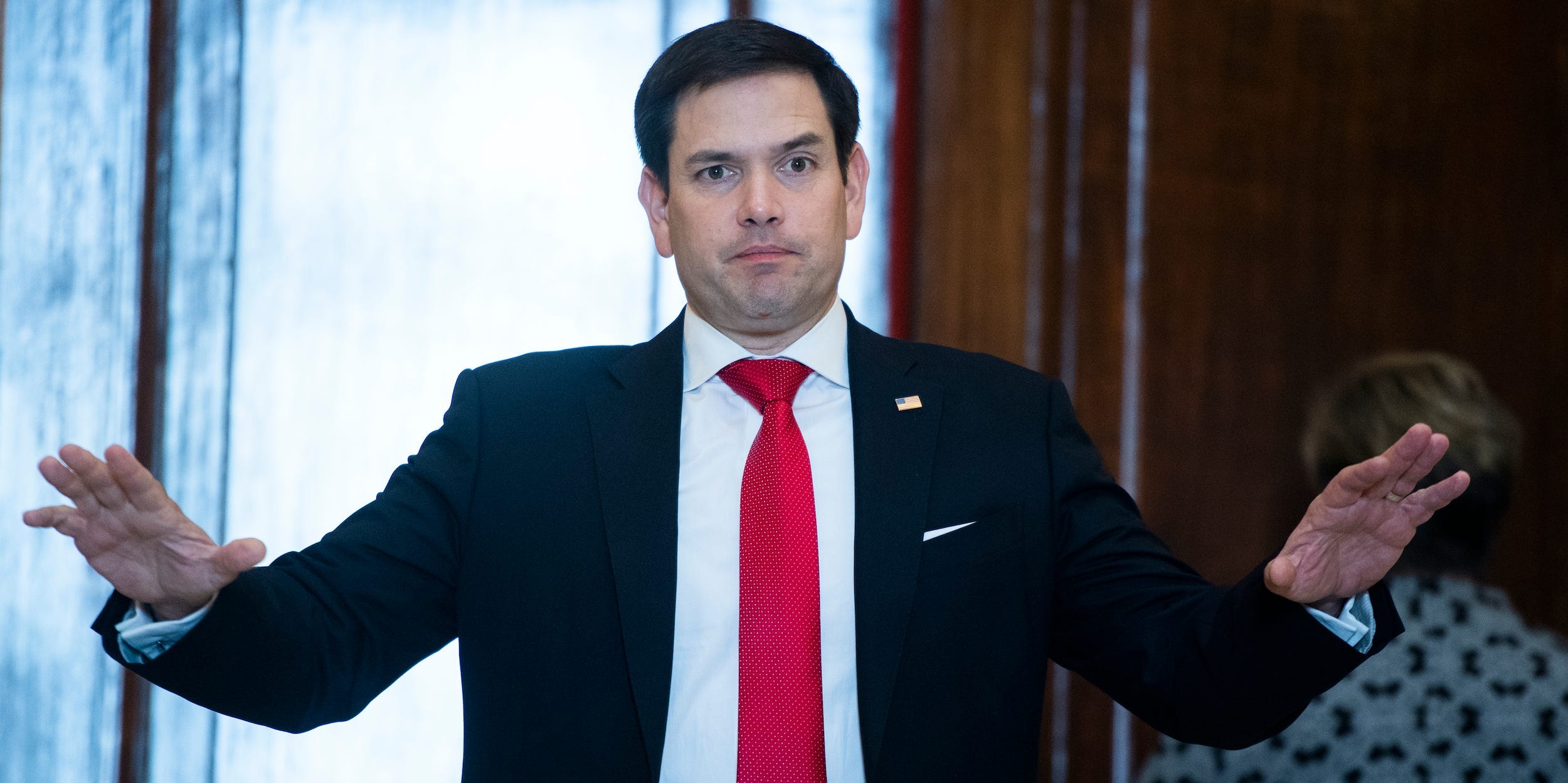

Tom Williams/CQ-Roll Call, Inc via Getty Images

- Sen. Marco Rubio blasted the "reckless and irresponsible" decision to grant Didi's US listing in an FT interview.

- He called Didi "unaccountable" as China's government blocks US regulators from reviewing its accounts.

- "That puts the investments of American retirees at risk and funnels desperately needed US dollars into Beijing," Rubio said.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Sen. Marco Rubio slammed the "reckless and irresponsible" decision to allow Chinese ride-hailing app maker Didi to list its shares on the New York Stock Exchange, speaking in a statement reported by the Financial Times Wednesday.

Rubio, one of the US government's most vocal China critics, described Didi as an "unaccountable Chinese company," and said Beijing's regulatory crackdown on the tech provider, which sent the stock lower, highlights the risks for US investors.

Didi's share price plunged more than 19% on Tuesday, after Chinese authorities at the weekend ordered app stores to remove its app from their platforms. The country's internet regulator earlier launched a review of its data security, and ordered it to stop registering new users.

"Even if the stock rebounds, American investors still have no insight into the company's financial strength because the Chinese Communist party blocks US regulators from reviewing the books," Rubio told the FT. "That puts the investments of American retirees at risk and funnels desperately needed US dollars into Beijing."

The type of business structure used by Didi "deprives foreign investors of vital legal protections they would otherwise enjoy through equity ownership," the Council of Institutional Investors said in a 2017 paper.

The Republican senator's comments suggest that Didi's IPO saga could fuel new efforts by US lawmakers to place tougher hurdles in the way of Chinese companies seeking listings in the US.

Last year, former President Donald Trump signed legislation that banned Chinese companies from being listed on US markets unless they conformed to American accounting standards.

The "Holding Foreign Companies Accountable Act" applies to companies from any country, but the sponsors of the law are seen as targeting it at Chinese companies listed in the US, such as Jack Ma's Alibaba, tech firm Pinduoduo, and oil giant PetroChina.

Didi's stock was last trading 4% lower in the pre-market session on Wednesday around 6.30 a.m. ET at $11.97 per share.